Managing your finances can be challenging, but having a structured budget in place can make a world of difference. A printable monthly budget planner is a great tool to help you keep track of your expenses, income, and savings goals. By having a visual representation of where your money is going each month, you can make more informed decisions and avoid unnecessary spending.

A printable monthly budget planner typically includes sections for income, expenses, savings, and debt repayment. You can customize it to fit your specific financial situation and goals. By filling in the planner each month, you can see patterns in your spending habits and identify areas where you can cut back or save more.

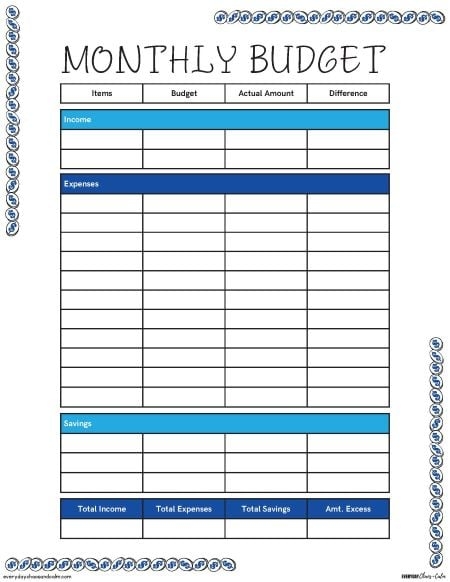

Printable Monthly Budget Planner

Printable Monthly Budget Planner

One of the main benefits of using a printable monthly budget planner is that it helps you stay organized and on top of your finances. By having all your financial information in one place, you can easily track your progress towards your savings goals and make adjustments as needed. It also allows you to see your overall financial health at a glance.

Another advantage of using a printable monthly budget planner is that it can help you plan for unexpected expenses. By setting aside a portion of your income each month for emergencies, you can avoid going into debt when unexpected costs arise. This can provide you with peace of mind knowing that you have a safety net in place.

In conclusion, a printable monthly budget planner is a valuable tool for anyone looking to take control of their finances. By creating a budget and tracking your expenses, you can make smarter financial decisions and work towards your long-term goals. Whether you’re saving for a big purchase or trying to pay off debt, a budget planner can help you stay on track and achieve financial stability.