Struggling to keep track of your expenses and savings? A printable budget planner could be just what you need to get your finances in order. With a budget planner, you can easily set financial goals, track your spending, and make adjustments as needed to ensure you stay on track.

Whether you prefer to keep things digital or enjoy the simplicity of pen and paper, a printable budget planner can help you take control of your financial situation and make informed decisions about your money.

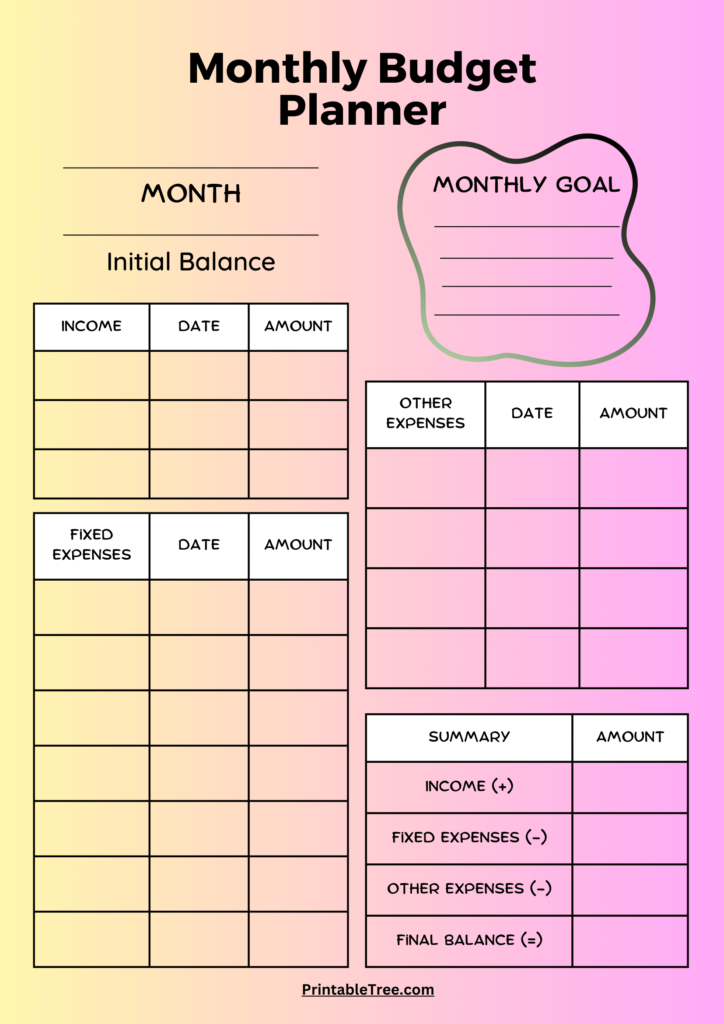

Printable Budget Planner

One of the key benefits of using a printable budget planner is the ability to customize it to suit your individual needs. You can include categories for different expenses, such as groceries, utilities, and entertainment, and allocate a specific amount of money to each category. This can help you see where your money is going each month and identify areas where you can cut back.

Additionally, a printable budget planner can help you stay organized and keep all of your financial information in one place. By regularly updating your budget planner with your income and expenses, you can get a clear picture of your financial health and make informed decisions about your spending habits.

Another benefit of using a printable budget planner is the ability to set and track financial goals. Whether you’re saving for a vacation, a new car, or a down payment on a house, a budget planner can help you stay on track and monitor your progress towards your goals.

Overall, a printable budget planner is a valuable tool for anyone looking to take control of their finances and make smarter financial decisions. By creating a budget, tracking your spending, and setting financial goals, you can achieve financial stability and peace of mind.

So why wait? Start using a printable budget planner today and take the first step towards a brighter financial future.